Biweekly compound interest calculator

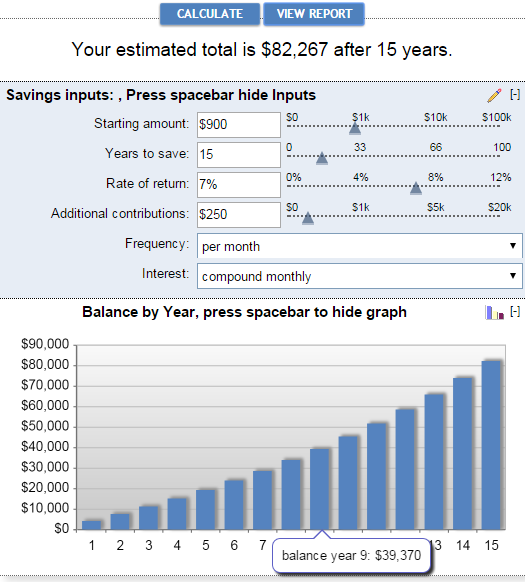

This calculator also offers a number of advanced options. N represents the number of periods.

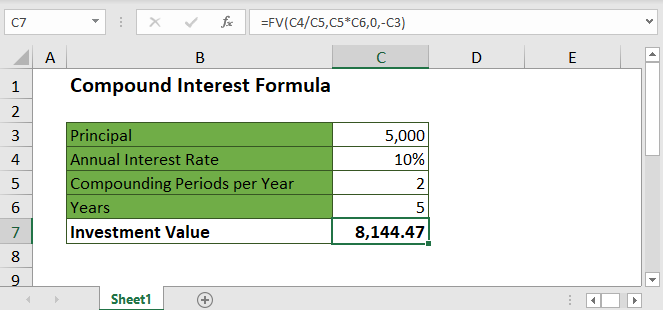

Compound Interest Excel Formula With Regular Deposits In 2022 Excel Formula Compound Interest Excel

Keep in mind that the earn rates vary but Haru gives you biweekly notice for transparency.

. The CUMIPMT function requires the Analysis. How we make money. Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

Tens of thousands of dollars can be saved by making bi-weekly mortgage payments and enables the homeowner to pay off the mortgage almost eight years early with a savings of 23 of 30 of total interest costs. If so this calculator will help you to estimate the interest due on a court awarded judgment. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule.

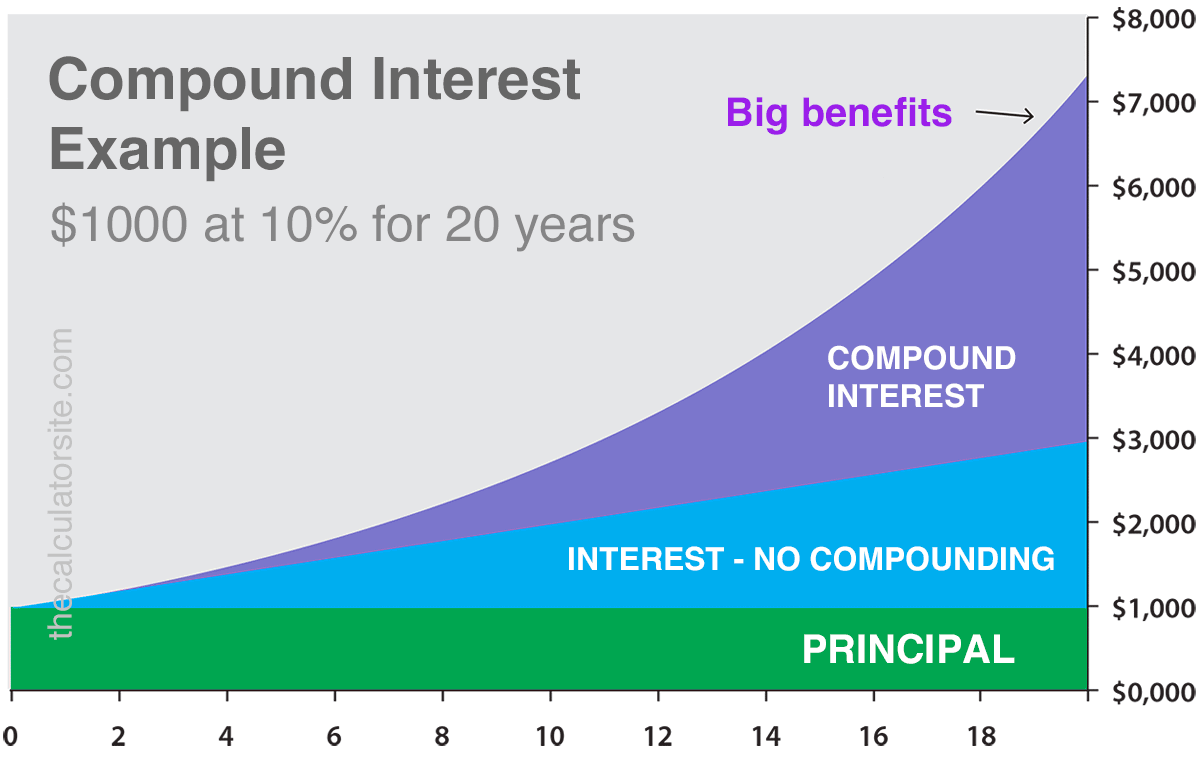

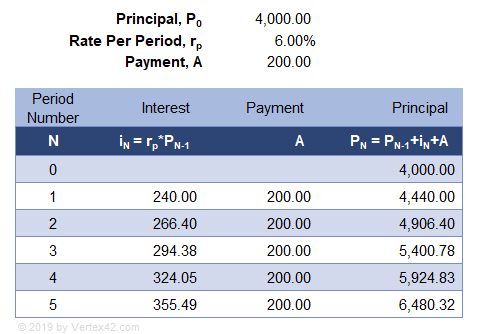

I represents the rate of interest earned each period. A t A 0 1 r n. With a crypto daily compound interest calculator to do the math for you you can even make various calculations to compare the results with different interest rates or deposit amounts to figure out if it is worth depositing a bit more.

If you have a 300000 mortgage at 4 for 30 years biweekly payments will save you 35000 in interest payments. Thus the payment amount declines from one period to the next. The calculation of compound interest can involve complicated formulas.

This Bi-Weekly Mortgage Calculator makes the math easy. This calculator will solve for any one of four possible unknowns. Bankrate is compensated in exchange for featured placement of sponsored products and.

It will figure your interest savings and payoff period for a variety of payment scenarios. PV represents the present value of the investment. This is the rate that is usually quoted by the lender.

Amount of Loan Number of Payments term Annual Interest Rate or the Periodic Payment Enter a 0 zero for one unknown value. This calculator assumes a fixed annual interest rate. Mortgages usually have 15 or 30-year terms.

If partial payments have already been made for some period of time you can enter the average payment amount of those payments and the number of payments which have already. This will be the only land contract calculator that you will ever need whether you want to calculate payments for residential or. If you initially had 5000 saved up and wanted to deposit 1000 at the beginning of the second year then you would set the initial deposit amount to 4000 as the other 1000 would automatically be added at the.

Even when people use the everyday word interest they are usually referring to interest that compounds. Deposits are made at the beginning of each year. FV PV x 1 in where.

For Excel 2003. Saving From Bi-Weekly Home Loan Payments. However simple interest is very seldom used in the real world.

See the note under Compound Period. Annual Interest Rate. The above calculator compounds interest yearly after each deposit is made.

Our calculator provides a simple solution to address that difficulty. FV represents the future value of the investment. The basic formula for compound interest is as follows.

The total number of years it will take to pay off the mortgage. The higher your interest rate and the more youve borrowed the more you could save. To calculate compound interest we use this formula.

The above calculator compounds interest monthly after each deposit is made. Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments. Compounding interest requires more than one period so lets go back to the example of Derek borrowing 100 from the bank for two years at a 10 interest rate.

The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf. You can make biweekly payments instead of monthly payments and you can make additional principal payments to see how that also accelerates your payoff. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage.

Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator. The compound interest equation basically adds 1 to the interest rate raises this sum to the total number of compound periods and multiplies the result by the principal amount. How the homeowner makes their mortgage payments can save a lot of money over the life of the loan.

Term of Loan in Years. However those who want a deeper understanding of how the calculations work can refer to the formulas below. Ultimately the borrower will pay less in interest charges with this loan method.

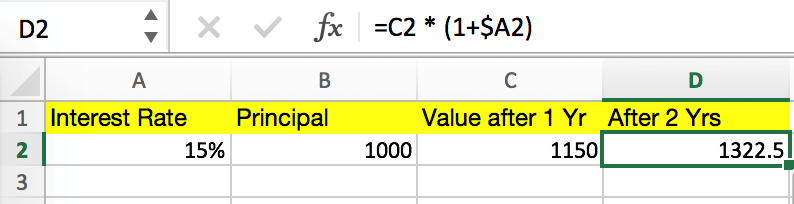

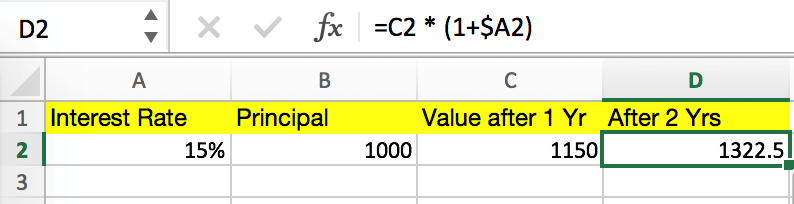

Compound Interest Formula And Calculator For Excel

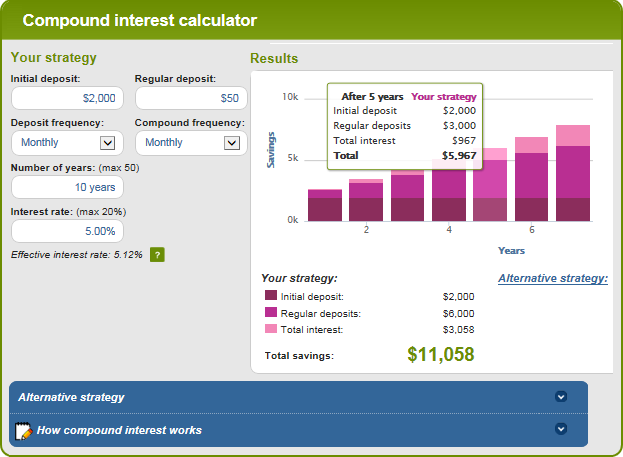

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator

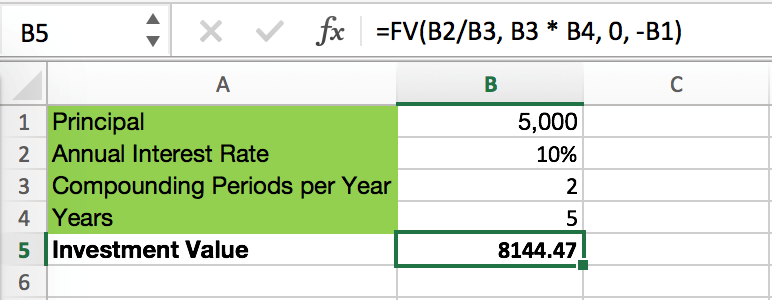

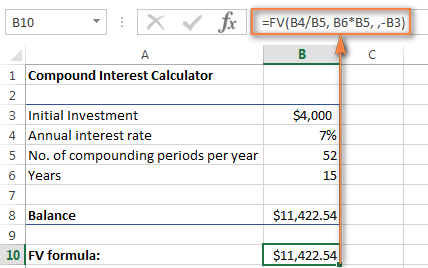

Compound Interest Formula In Excel And Google Sheets Automate Excel

Compound Interest Formula In Excel And Google Sheets Automate Excel

Compound Interest Formula And Calculator For Excel

Compound Interest Formula In Excel And Google Sheets Automate Excel

Compound Interest Calculator Daily Monthly Quarterly Annual

Effective Interest Rate Method Excel Template Free In 2022 Excel Templates Excel Templates

Compound Interest Calculator For Excel

Compound Interest Formula And Calculator For Excel

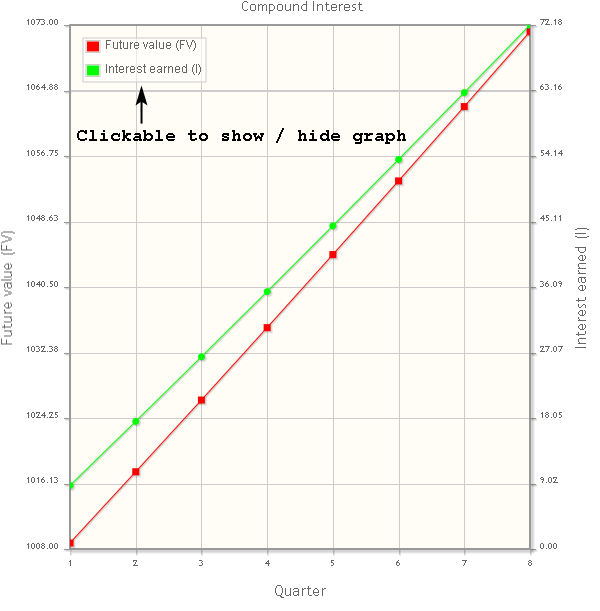

Mobilefish Com Compound Interest Calculator With Graph

Loading Savings Advice Budgeting Money Management

Compound Interest Calculator For Excel

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator With Formula